What Happened Today?

The Federal Reserve announced a 0.25% rate cut in today’s FOMC meeting. That might sound like great news for mortgage rates… but don’t be too quick to celebrate. Despite the headlines, mortgage rates actually worsened after the announcement.

Why? Because the bond market—the real driver of mortgage rates—had already priced in the Fed’s move weeks ago.

The Fed Doesn’t Set Mortgage Rates

Let’s clear up a common misconception: The Federal Reserve does not set mortgage rates. Instead, it controls the Federal Funds Rate, which is the interest rate banks charge each other for overnight lending.

Mortgage rates are determined by the bond market, especially the performance of 10-year U.S. Treasury yields and Mortgage-Backed Securities (MBS). These markets are forward-looking and react immediately to economic data—long before the Fed makes its move.

By the Time the Fed Acts, It’s Already Priced In

The Fed only meets eight times per year to adjust monetary policy. Meanwhile, the bond market is responding in real-time to daily economic reports such as:

- CPI (Consumer Price Index)

- PCE (Personal Consumption Expenditures)

- Non-Farm Payrolls

- Unemployment Rate

- Initial & Continuing Jobless Claims

- JOLTS (Job Openings and Labor Turnover)

- PPI (Producer Price Index)

- Philly Fed Index

This means mortgage rates usually move ahead of the Fed—not because of it.

Case in point: Mortgage rates have dropped approximately 5/8% since July—long before today's rate cut announcement.

So Why Did Rates Get Worse Today?

Even though the Fed delivered the expected 0.25% rate cut, mortgage rates increased slightly after the decision. Why? Two reasons stood out:

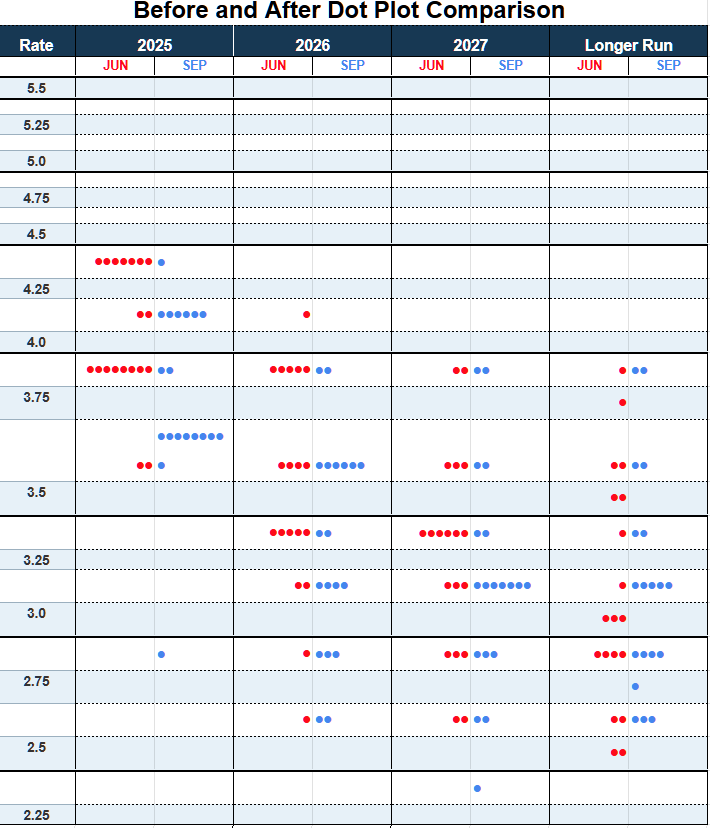

1. The “Dot Plot” Shifted

The Fed’s updated dot plot (a chart showing where each Fed official projects rates over time) was more hawkish than markets had hoped. While it showed the potential for two cuts in 2025, it lacked urgency and clarity.

2. Powell’s Press Conference

During the post-announcement press conference, Fed Chair Jerome Powell made a statement that unsettled investors:

“Individual forecasts are not a plan. Policy is not on a preset course.”

This signaled a more cautious, data-dependent approach rather than a commitment to more cuts this year. The bond market—which had been rallying in anticipation of a dovish message—reversed course.

Result: Bond yields rose, pushing mortgage rates slightly higher despite the Fed's cut.

Visual Recap: Mortgage Rates vs. The Fed

Take a look at the chart below tracking the average 30-year fixed mortgage rate over the past two months. Note the yellow arrows marking FOMC meetings and the green trend line reflecting the broader decline in rates:

As you can see, mortgage rates had already fallen before the Fed acted. This proves that mortgage rate movement is not dictated by the Fed’s calendar—but rather by the bond market’s outlook on inflation and economic growth.

Key Takeaways

- The Fed does not directly control mortgage rates.

- Mortgage rates move in response to economic data—not Fed announcements.

- Today’s 0.25% Fed cut was already priced in, and mortgage rates worsened afterward.

- Just because the Fed cut rates does not mean your mortgage rate dropped by 0.25%.

What Should You Do?

Despite today’s short-term bump, we’re still seeing the lowest mortgage rates since October 2024. If you’re considering a home purchase or refinance, this could be a strategic window.

But don’t try to time the market alone—rates can change quickly with the next jobs report, inflation reading, or Fed speech.

Let’s Talk Strategy

If you have questions about locking in a rate, structuring your mortgage, or understanding how current economic trends affect your home financing, let’s connect.